It’s tax season! We’re sure you know this from personal experience: getting your tax refund can get really messy! First, the paperwork keeps stacking up, making you feel overwhelmed. Then you get the nagging doubt that you might not be receiving all (or any!) of your money back.

Most people don’t know there are special conditions in which you may qualify to receive money back on your extended stay lodging expenses. CLS™ has alerted clients to nearly $100,000 back on single projects; we help you find opportunities to recoup the taxes paid for your extended stays.

About long-term lodging taxes

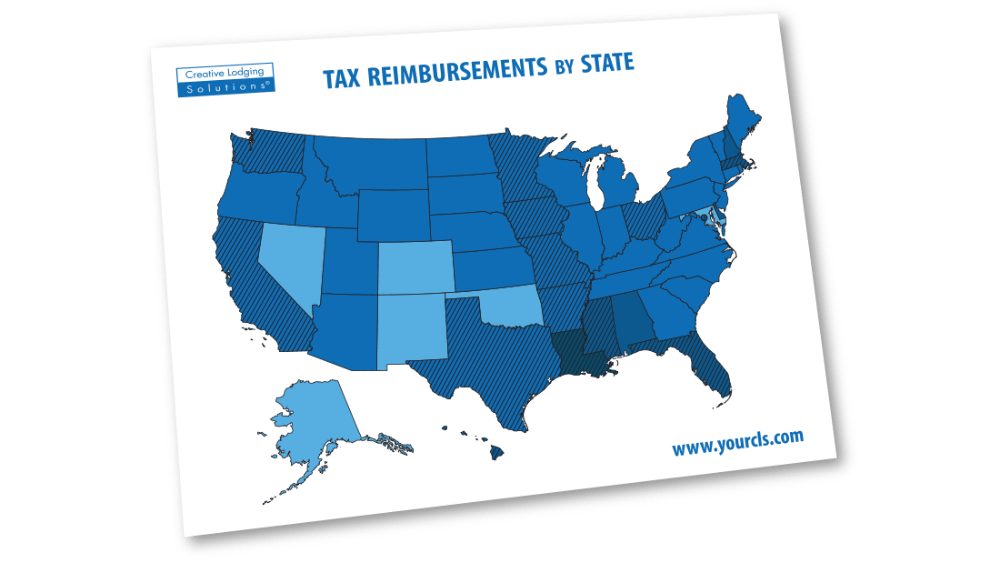

Here’s the deal: Certain states consider you a citizen if you’ve stayed a designated number of nights. Consequently, hotels will no longer tax you for a portion or all of your stay after you’ve reached that minimum number. You may have a right to get reimbursed for any nights that are considered exempt by state law. Are you getting the returns you deserve?

Number of nights

Many travel management providers neglect this potential benefit because it’s quite complicated to uncover those lost tax dollars. How? Let me count the ways! First, different states have varying definitions of how long you have to stay before becoming eligible for a tax refund. While many require as little as 30 days, other states require that you stay up to a year. Unfortunately, a few states don’t offer tax reimbursement at all. Some hotels give back money for all nights stayed while others only reimburse for nights beyond the taxable night umbrella. For example, a hotel that offers tax benefits for stays of 30+ nights might start counting eligibility from your first day, while others will start counting from your 31st day. Sounds a little complex, right?

Getting your returns

This process gets even more complicated as we talk about actually getting the reimbursement. Some hotels automatically send you a check (or alternate method) for the returned funds, and others hold the money. What does that mean for you? You’re likely to lose out on that refund unless you have a travel advocate watching out for you. Very few hotels give you the fine print when you check in. Creative Lodging Solutions™ can handle the details! Let us help monitor your lodging taxes, and you’re likely to see some huge monetary rewards for your company! We can help you identify those…

Again, we’ve found refunds of nearly $100,000 per project! You don’t want to miss out on this opportunity to see large figures landing in your company’s bank account!

A thousand reimbursed is a thousand earned, right?

Recent Posts

-

Demolish the Biggest Frustrations in Construction Travel

Nov 19, 2024 | -

Thanksgiving 2024: What Restaurants are Open for the Holiday?

Nov 19, 2024 | -

Building a Travel Program for Project-Based Construction

Nov 08, 2024 |